Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

In a fast-paced digital world, the efficiency of online transactions is both a convenience and a necessity. The speed and reliability of these transactions directly impact customer satisfaction and business performance.

As e-commerce and online services continue to grow, optimizing transaction processes becomes crucial for staying competitive. This article suggests best practices for enhancing the efficiency of online transactions, offering insights and strategies to businesses and consumers alike.

1. Understand Payment Gateways

Selecting an appropriate payment gateway is crucial for the smooth operation of online transactions. A payment gateway facilitates the transfer of information between a payment portal (like a website or mobile app) and the front-end processor or acquiring bank.

When evaluating gateways, businesses should consider factors like transaction fees, settlement time, and ease of integration with existing systems. It’s also vital to ensure that the gateway supports multiple currencies and is adaptable to various international payment standards, which is essential for global business operations.

Moreover, businesses should assess the gateway’s capability to handle high transaction volumes, particularly during peak times, to avoid any system overloads or slowdowns.

2. Consider Payment Facilitators

Payment facilitators are becoming increasingly popular as intermediaries in the online payment ecosystem. They simplify the merchant account enrollment process, allowing businesses to accept payments more quickly than traditional merchant accounts.

Payment facilitators oversee the underwriting process, risk monitoring, and compliance with payment regulations, thereby reducing the administrative burden on businesses. They often provide additional services like customer support and dispute resolution, which can be especially beneficial for small to medium-sized businesses lacking extensive resources.

A strong partnership with payment facilitator companies can also offer insights into emerging payment trends and technologies, keeping businesses ahead in the competitive digital landscape.

3. Ensure Mobile Optimization

As mobile commerce grows, optimizing for mobile users is no longer optional but imperative. This includes designing responsive websites that adjust the content layout based on the device being used.

Also, streamlining the checkout process for mobile users, such as by implementing one-click purchasing or using digital wallets like Apple Pay or Google Pay, can significantly reduce friction.

Speed is also a critical factor; optimizing images and using accelerated mobile pages (AMPs) can improve page load times, thereby enhancing the user experience. Mobile optimization also extends to email communications and notifications, ensuring they are mobile-friendly and easily actionable.

4. Prioritize Security

Online transactions are a prime target for cybercriminals, making robust security measures essential.

Using secure socket layer (SSL) technology ensures that all data transmitted between the user and the website is encrypted. Employing two-factor authentication (2FA) adds an extra layer of security by requiring a second form of identification beyond just a password.

Regular security audits and compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) are crucial. Additionally, implementing fraud detection tools that use advanced algorithms to monitor suspicious activity can prevent unauthorized transactions and protect both the business and its customers.

5. Integrate AI And Machine Learning

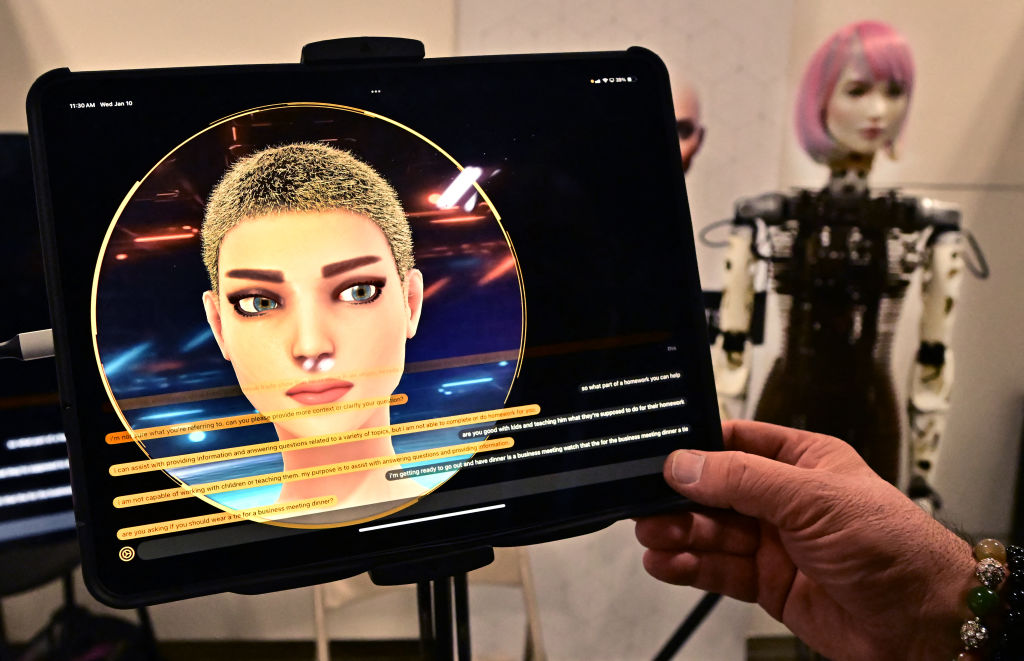

Artificial intelligence (AI) and machine learning (ML) can transform various facets of online transactions. For example, chatbots powered by AI can handle customer inquiries and facilitate transactions, improving customer service efficiency. ML algorithms can personalize the shopping experience by recommending products based on the customer’s browsing and purchasing history.

In fraud detection, these technologies can identify patterns that might indicate fraudulent activity, thereby reducing false positives and improving accuracy in fraud detection. Furthermore, AI can automate repetitive tasks like inventory management, freeing up resources to focus on more strategic activities.

6. Utilize Analytics for Improvement

Data analytics enables businesses to make data-driven decisions to enhance online transaction efficiency. This includes analyzing customer journey data to identify where customers are dropping off in the transaction process and making necessary improvements.

Heat maps, for example, can show how users interact with a website, highlighting areas that attract the most attention and those that are overlooked. Predictive analytics can forecast future buying behaviors, allowing businesses to tailor their marketing and inventory accordingly.

Regularly monitoring key performance indicators (KPIs) like conversion rates, average order value, and cart abandonment rates can provide valuable insights into the effectiveness of different strategies and areas for improvement.

7. Encourage Customer Feedback

Active engagement with customers through feedback helps in refining the online transaction process. This can be facilitated through surveys, feedback forms, or direct communication channels like social media and customer support.

Encouraging customers to review their purchasing experience provides insights into what works well and what needs improvement. Responding to feedback, both positive and negative, shows customers that their opinions are valued, fostering loyalty and trust.

Implementing changes based on customer feedback can lead to a more user-friendly and efficient transaction process, ultimately enhancing the overall customer experience.

Conclusion

Maximizing efficiency in online transactions is a multifaceted endeavor that requires attention to security, user experience, and technological advancements. From choosing the right payment gateway to leveraging AI and customer feedback, each strategy plays a vital role in streamlining the process.

By adopting these best practices, businesses can enhance customer satisfaction, secure repeat business, and stay ahead in the digital marketplace.

ⓒ 2023 TECHTIMES.com All rights reserved. Do not reproduce without permission.

* This is a contributed article and this content does not necessarily represent the views of TechTimes.

Tags: